Canada Education Trust Plan

You will see your principal balance and total balance. Registered education savings plan and the cst difference.

Canadian Scholarship Trust Plan

Its the smart simple and flexible solution to help you make your childs dreams become a reality.

Canada education trust plan. As the distributor and investment manager of the canadian scholarship trust plans cst. With a wide range of investment options available youre sure to find an resp at td thats right for you whether an individual beneficiary or family beneficiary plan. Download the plan summary and detailed plan disclosure prospectus or call us at 1 877 333 resp7377 to receive a copy.

Canadian scholarship trust plans are only sold by prospectus. An educational trust specifies that trust funds are to be used for education. The money that you invest in an resp grows tax deferred and the federal government helps contribute to your savings along the way in the form of education grants.

A registered education savings plan resp can help make saving for a childs education easier. If the trust will become operational immediately see below about this then the grantor funds the trust by transferring property into it. Education savings registered education savings plans a registered education savings plan resp is a special savings account for parents who want to save for their childs education after high school.

A registered education savings plan resp is a government registered savings plan that helps you save for your childs post secondary education. Established in 1998 we have become one of the fastest growing companies in the registered education savings plan resp industry. The student each cst resp plan has two views online.

Global resp corporation gresp is a recognized leader and provider of registered education savings plans in canada. The canadian scholarship foundation is one of canadas largest and oldest group registered education savings plan resp providers in canada with over 59 years of experience providing education savings solutions to families across canada. The parent or as a beneficiary ie.

In the trust document the grantor names a trustee and beneficiaries and also states how trust money is to be used. The parent youll see all the plans associated with all of your beneficiaries ie. Sign in as a subscriber eg.

Investors should read the prospectus before making an investment decision because it includes important detailed information. If you log in as the subscriber eg. Cst bright plan tm is a registered education savings plan resp that helps you save for your childs education after high school.

Td canada trust resp.

Cst Consultants Inc Announces 2019 Investment Returns For

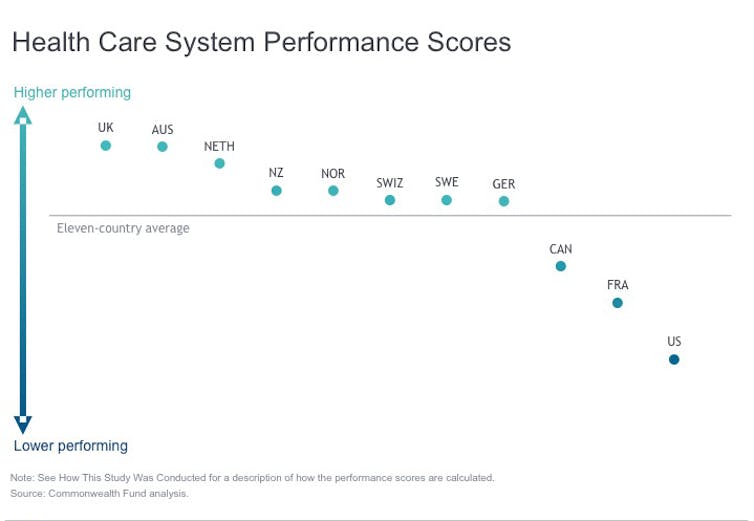

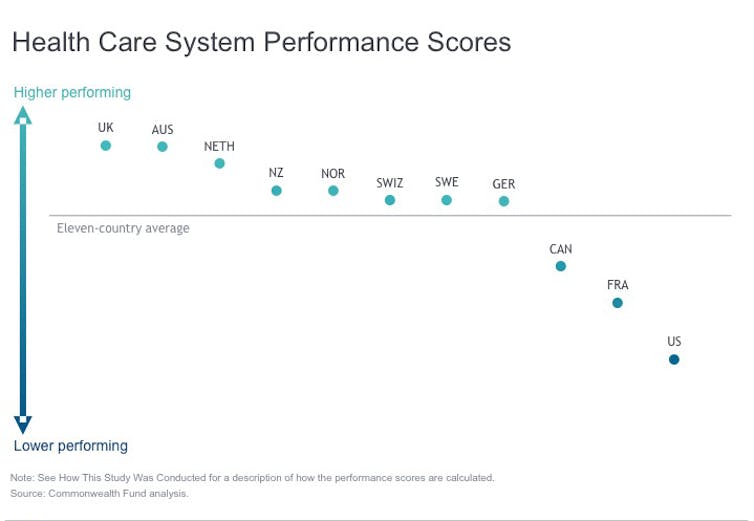

How Healthy Is The Canadian Health Care System

Group Resp Registered Education Savings Plan Unlawful Enrollment

Cst Consultants Inc Linkedin

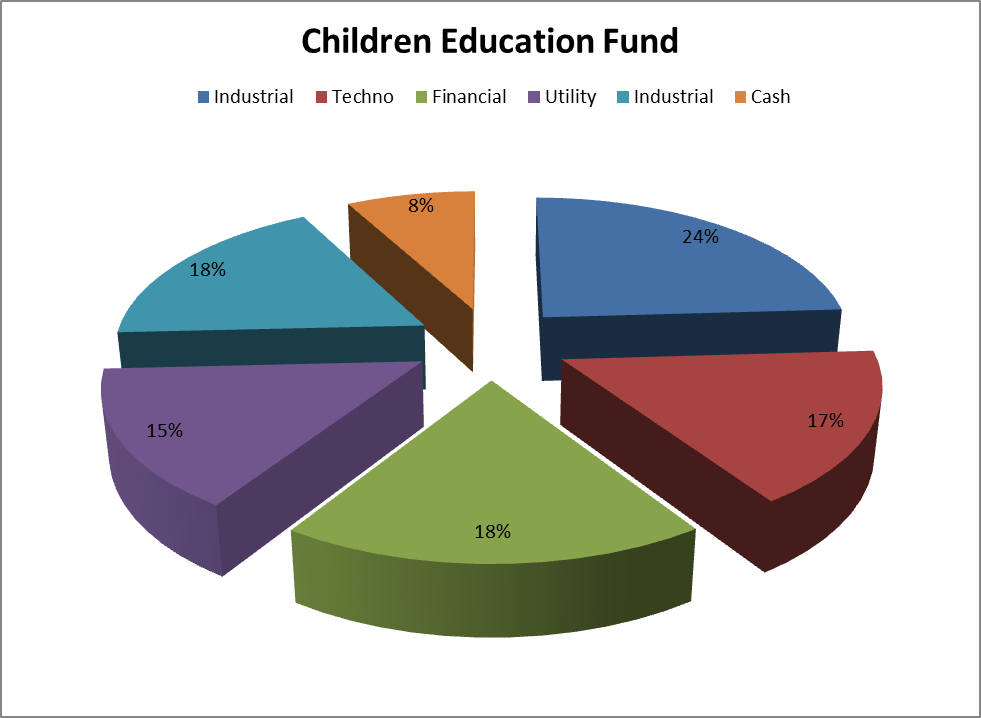

Resp Registered Children Education Savings Plan Canada Do One

Page 69 Der Moment Issue 120

/GettyImages-486927830-6163e3efc6624710a3438c0961ffcdc7.jpg)

Registered Education Savings Plan Resp

How To Start An Education Fund For Your Kids Seeking Alpha

Http Cbaapp Org Classaction Pdf Aspx Id 9311